First off, let’s talk about what Sinking Funds are, just in case you haven’t heard of them.

A sinking fund is a savings account that is specifically for one purpose.

To be honest, I started using them before I knew there was a name for them. I used to keep money in one savings account for everything and it was an “emergency fund,” but then I realized I was having trouble keeping the money there since a lot of stuff happens! So I started a list of the things I could reasonably anticipate and broke up the expenses by month so I could save for them separately.

This way when an unexpected expense occurs, I have a specific place to draw the money from.

It took me years to have the system I have now and even now I know that I will likely add others (or delete some) when my life changes, as it always does.

Now, the money could be in an actual account solely for that purpose, or it could be in an account that has all of these pooled in. (Preferably separated in some way.)

Personally, I use both methods.

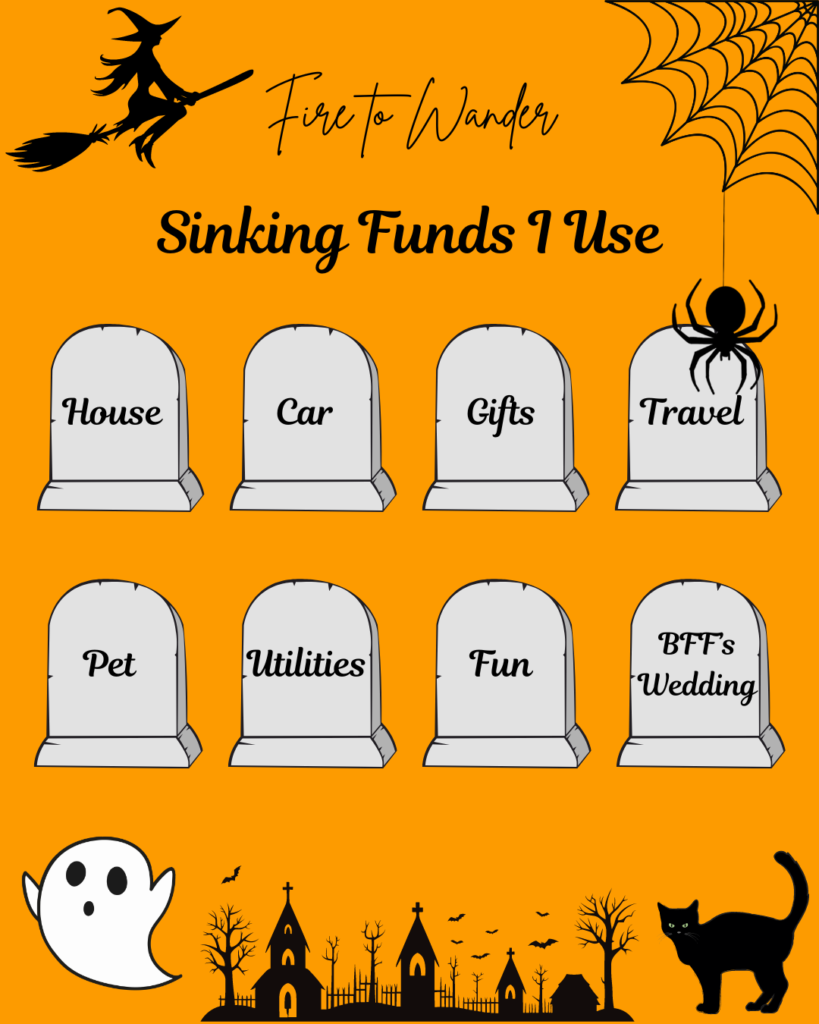

My Sinking Funds

These are the sinking funds that I currently contribute to:

- House fund for my mortgage, insurance, property taxes, and repairs.

- Car fund for yearly registration, inspection, maintenance, and repairs.

- Travel fund for trips I can take throughout the year.

- Gifts and donations fund for anything I’ll be giving throughout the year whether it’s birthday gifts, xmas gifts, showers, etc. I also add extra to my gift calculations because I do like to donate to causes I value.

- Pet fund because I don’t spend the same amount every month on my cat’s food, litter, and vet visits. I usually buy supplies every few months, but since it’s on auto order it’s a lot more money than one bag here and there. Therefore, every month I put money in this bucket so that when the bill comes I can take it from here.

- Utilities fund since the electricity and water bills are not usually the same every month of the year and I refuse to do “average billing.” I know my average, so I plan to spend that per month and whatever I don’t spend goes here. Then when the bill is higher than average, I pull the difference from here.

- Fun fund is variable. I have $200 per month that I can spend however I want. If I don’t spend it all, I can put the rest in this fund or I can invest it. If I get a bonus or some unexpected money, I add some in here so if I ever want to spend it on whatever I want, I can. Historically, I’ve spent this fund on travel as well. What’s more fun than exploring a different country?

- BFF’s Wedding(s) fund is new this year because she’s getting serious with someone and they’re talking about having THREE weddings! I already cannot…sooooo I’m slowly throwing some funds in here so that when the time comes I don’t feel overwhelmed by the expenses. Especially since literally no matter where all three of them are: I WILL BE THERE! Thankfully, he has a three year plan to propose so I have time to save! He’s already shown me some ring ideas. I’m so happy she’s found a good person who truly values her and is planning ahead!

Where I Keep Them

I have separate High Yield Savings Accounts for: House, Car, and Travel. The rest of the funds are kept together in one account that allows me to have “buckets” for each thing and so even though it’s one account, it’s split up into each of these funds. This makes it easier to keep track of what each fund has.

I love this system because it allows me to have my mortgage, property taxes, and insurance drawn from my House account directly without affecting the withdrawal limits of the other accounts. (If you haven’t heard of withdrawal limits, all savings accounts have them. They offer you better interest than a checking account, in exchange for you actually leaving your money there. I think the monthly withdrawal limit is usually 6, but check with your own accounts.)

Aside from the House Fund, all the other funds could probably be in one account with buckets, but I already had the separate accounts prior to discovering an account that has buckets and I have no reason to change my system especially when I like my original bank.

I also have an emergency fund account, but I’ll leave that for another post.

If you don’t already use sinking funds, I highly recommend that you start to. It truly makes your life so much easier to be able to quickly see how much you have for a specific thing rather than having to take out your spreadsheet to figure it out each time you need something. (Like I used to do back in the day!)

Leave a Reply