I have chosen to post my third quarter stats in different posts because it’s been a huge pain in the ass trying to get all of my numbers together. I’m almost done, but some things have been easier than others.

I’ll be starting with income. That one is easy! What’s gone into my bank account this quarter? lol! The expenses are the pain in the ass since it means downloading all transactions from all over the place.

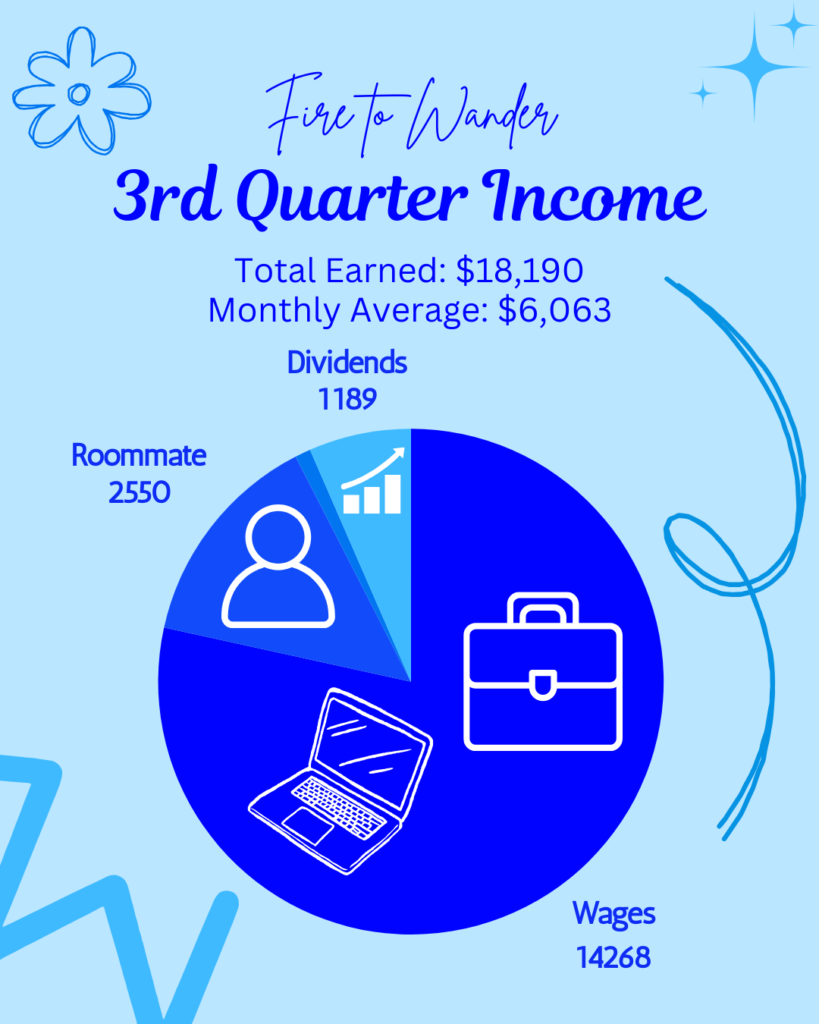

Honestly, even income was a little annoying because I do have various accounts. Plus, I automatically know to include my wages and what my roommate has been paying monthly, but then I also have interest, dividends, and misc. income. I’ll do a much better job of tracking these moving forward so I can post on time, lol. Mainly so I can actually know what’s up, but posting too.

Now, the income is only the amounts I’ve received after contributing to my retirement accounts and paying for my benefits. Also, it’s important to note that I switched jobs a few months ago and unlike most jobs where you work and get paid the full amount you earned, teachers don’t usually get that luxury. They like to treat us like we’re children ourselves and divide our income into the 12 months of the year, rather than paying us for the time we work when we’ve earned it. Does it sound like I’m bitter about that? It was annoying, to be honest.

Also, when you quit (unless you quit midyear) you don’t automatically get everything you’ve already earned and not received yet. You have to wait and get paid out on the same monthly schedule you would’ve gotten paid on if you’d decided to renew your contract.

One of my friends said it was nice that I was getting a double paycheck during this time. Lol, hell no. It’s not a double paycheck! I had already earned my money, they were just holding it hostage!

Just to be clear: I actually loved teaching while I did it. I thoroughly enjoyed imparting wisdom on the young minds of the community. I loved how funny and interesting the students were. I loved getting to teach them about personal finance and seeing some light bulbs turn on brightly! I want my community to do better and the best way to attain that is by educating them on personal finance.

Tangent: I don’t think you have to go to college to do well in life. I know that’s the lie we were fed and that’s why I ended up with 50k in student loans because my mom was not able to pay for my tuition. (I’m truly glad I went, no regrets.) However, I want everyone to know that as long as you make money, spend less than you earn, and invest the difference: you can have a great life with enough money to live on! Hell, everything I’ve done so far has been as a teacher, and even now, with less than an 80k income. It might end up being a little over that this year, merely due to this whole hostage pay thing.

Back to our teaching topic: Most of all, I loved having three months a year to travel and live my best life! This past decade has been so amazing for me and I’m so glad I made the decision to teach!

Anyway, after that decade of teaching, I decided that I need to start looking to make a higher salary so that I can live without requiring side hustles and also without needing a roommate in order to invest more. (That’s always an option, and I am not opposed to that.) Especially since I want to retire in 2032. Since I only have 8 years of work left in me, 7 since I want to take a year off. (I’ll write about that later.) Therefore, I need to make more money now! I made a pivot and I landed where I currently am. (Which I am LOVING so far, by the way!)

Without further ado, my Q3 income:

It will be drastically different next quarter since not only will my wages be lower due to what I mentioned earlier, but also: my roommate is moving out!

It’s such a bittersweet moment. On the one hand: I am so happy to live alone again and I cannot wait to not deal with the messiness and the extra cat hair, but on the other: I actually love hanging out! Plus, the rent is good too! Haha!

Leave a Reply