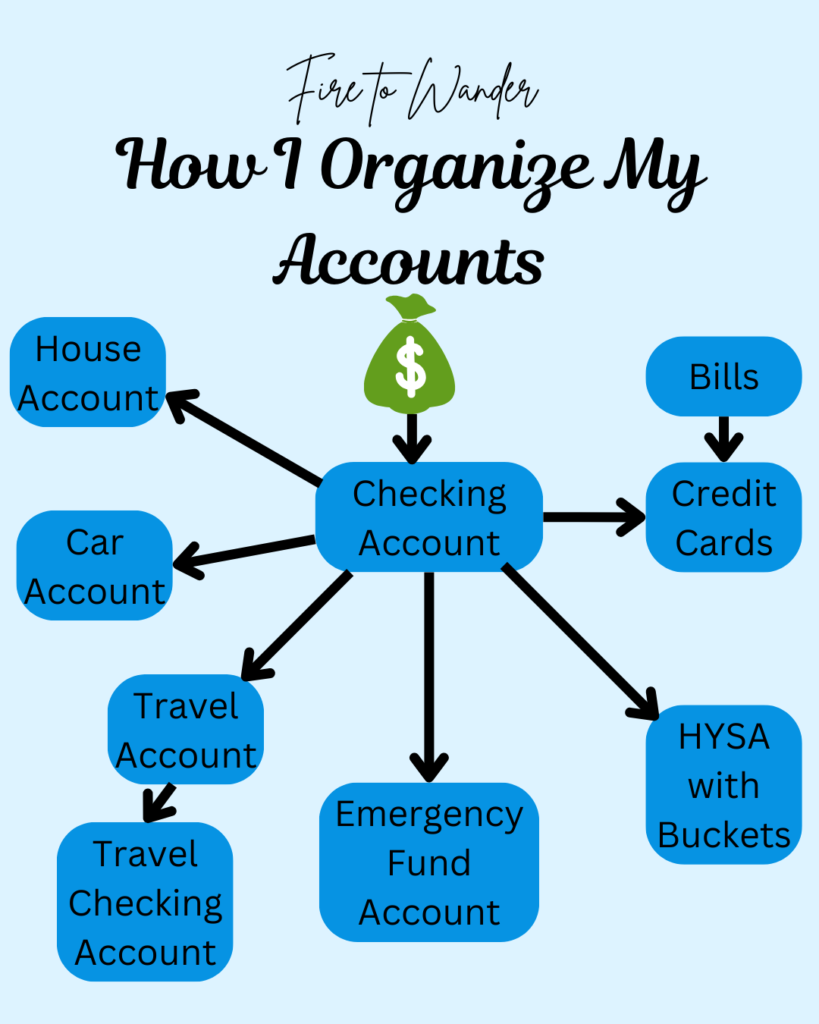

I feel like I have a simple system. It includes a lot of accounts, but it makes it easy for me to see how much I have for each purpose and thus keeps my financial life organized.

Money Flow

On payday: my money goes into my main checking account. (This is after taxes and retirement investing.)

There is an automatic transfer from my checking account to my House Account, Car Account, Travel Account, and Emergency Fund Account.

This is because these accounts will get the amount they are budgeted to get every month, no matter what.

My HYSA gets a transfer as well, but that one is manual. That account houses buckets for all of the expenses that are variable so I only send funds in there after the month is over and I know I didn’t use it.

For example: I budget $400 for my utilities every month. The amount I spend is not usually $400. Most months, I will spend less than that so I will take the difference and put it in the Utilities bucket of my HYSA. The couple months a year when it’s more than that, I simply transfer the amount needed from the Utilities bucket. Same goes for the amount I budget for my cat. If it is unused, it gets sent to the Cat bucket. I do the math for all of these at the end of the month and send over anything that wasn’t used.

The travel checking account only gets used when I go on vacation. That account has atm fee reimbursements all over the world, so I use that if I’ll need to withdraw cash. This way, I am not touching anything else for my fun and don’t have to think about it: if there is money in the account, I can use it.

Expenses

All of my expenses go on credit cards. It’s a lot easier for me to keep track of my spending if I can always access a record of it. Particularly one that I didn’t have to create. Plus, I don’t like to lose cash. As a bonus, I earn rewards for my regular spending, so it’s nice to be able to treat myself for free.

All of my credit cards are set to auto-pay the Statement Balance on each due date. This way, I never forget to pay any of them and I never pay interest or fees.

The only expenses I do not pay on my credit cards are my house expenses like: mortgage, property taxes, and insurance which get withdrawn straight from the house account.

Issues

The one thing I always get push back about is the credit card auto-pay. Since my spending is generally consistent from month to month, I don’t worry about the withdrawal amount being crazy different from month to month. Also, you can leave a savings buffer in your checking account if that helps you feel better.

I used to always keep $1,000 as a minimum so that I knew I wouldn’t overdraft no matter what. Then at some point it went down to $100. (I know some people like to keep a crazy high number in their checking account, but I personally don’t like cash just sitting there earning nothing. Perhaps when I’m wealthy I’ll change my approach.) I always double check toward the end of the month, when the withdrawals are about to start, to make sure the total of the statement balances is definitely in the account.

Overall

I love my system. It allows me to know I have money socked away for when I need it, but I don’t have to keep a hoard of cash sitting in my checking account doing nothing for me.

Checking I have enough funds in the checking account at the end of the month takes maybe 10 minutes. It’s pretty simple.

Leave a Reply