There are many different types of accounts where you can invest from. The account itself isn’t the investment. The account is merely the basket that holds the investments.

The type of account is what determines what benefits you get from investing within that account.

There are two basic account breakdowns: 1. employer sponsored, which you only get access to if your employer provides it and 2. self-directed accounts, which means you open it on your own and your contribute without a middleman.

You can have access to many different investment accounts on each side of the divide. Let’s go through a few.

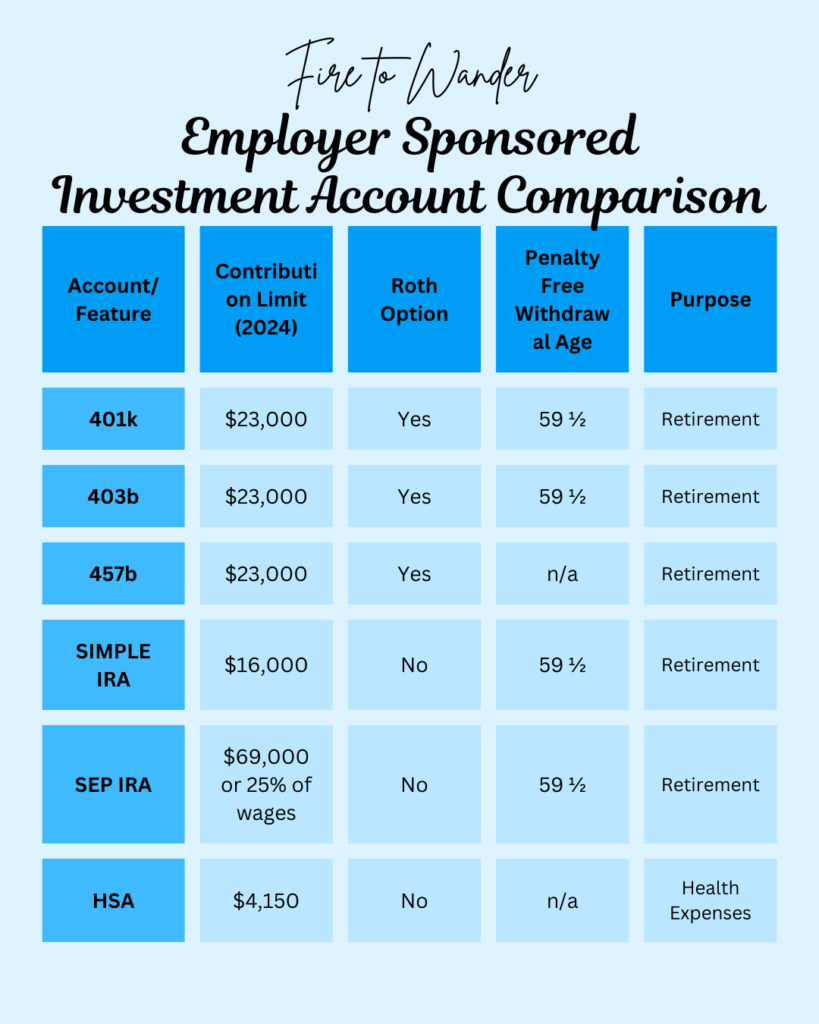

Employer Sponsored

- 401k – This one is the most well known employer sponsored account. The company usually provides some sort of match for you based on your contributions. Larger private companies tend to have these. There are two varieties: Traditional and Roth. The rule of 55 allows you to have penalty-free distributions if you leave work in the year you turn 55 or older.

- 403b – This is basically the non-profit organizations and public schools. These do have the option to have a match by the employer. Sadly, I’ve never seen a match be available for public schools, but hopefully that’s just been my experience. There are two varieties: Traditional and Roth. The rule of 55 allows you to have penalty-free distributions if you leave work in the year you turn 55 or older.

- 457b – This one is offered to state and local government employees as well as to employees of some non-profit organizations. There’s one major difference between this one and the previous two: once the employee separates from their employer, they can begin to draw on their account without penalties. Another amazing thing about this one is that the contribution limit is separate from 401k & 403b accounts. There are two varieties for this one as well: Traditional and Roth.

- 457f – This one is for “highly compensated employees and executives” that are not in government, but in tax-exempt organizations. This one has conditions that must be met to avoid losing your money.

- Savings Incentive Match Plan for Employees (SIMPLE IRA) – This one is one that small businesses can provide. The employer is required to make contributions for their employees. There is not a Roth option available.

- Simplified Employee Pension IRAs (SEP IRA) – This one is also used by small businesses, but can be opened by self-employed people as well. This type of account requires the employers to make contributions, but the employee does not contribute. There is not a Roth option available.

- Health Savings Accounts – These are generally checking accounts that you can withdraw funds from to pay for medical expenses. However, some accounts allow you to link an HSA Brokerage account so you can invest your HSA funds. These can be employer sponsored, or self-directed. There are no penalties or even taxes for withdrawing from this account to pay for medical expenses. There is a 20% penalty if you are withdrawing for non-medical expenses. After age 65, you can withdraw for any reason and not pay a penalty, only taxes on the distribution.

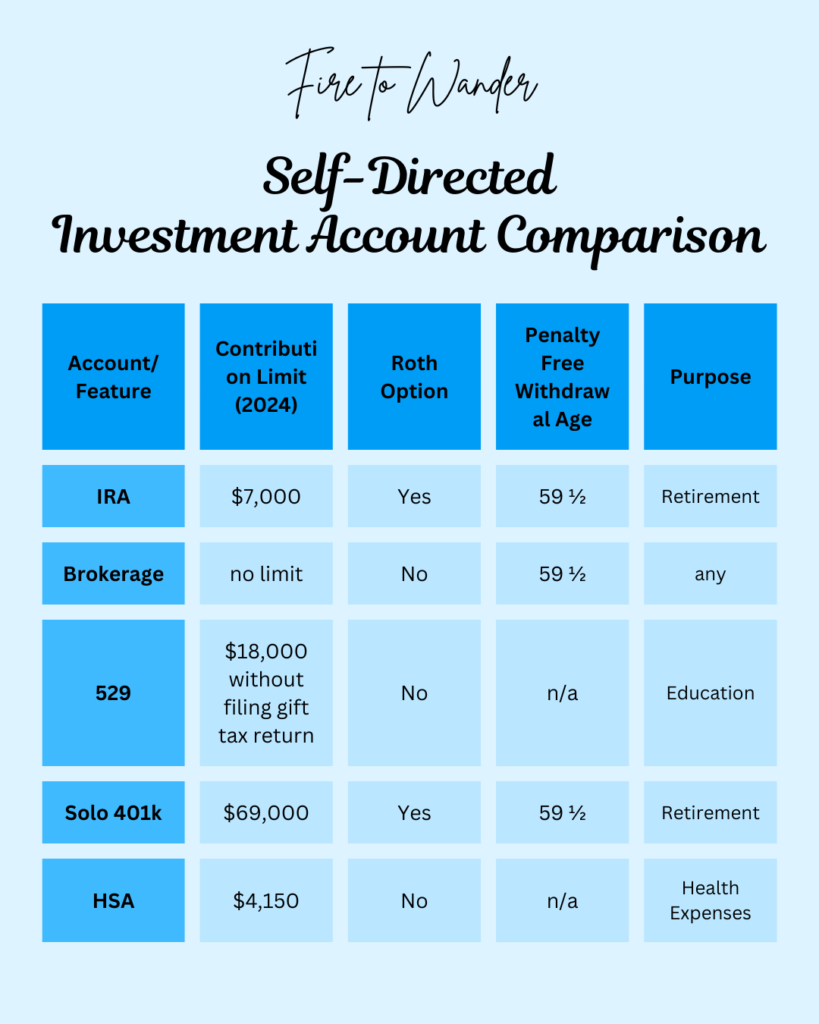

Self-Directed

- Individual Retirement Account (IRA) – It’s mainly for people who don’t have a workplace retirement account available to them. There are two varieties: Traditional and Roth.

- Brokerage – This one is not a retirement plan, so there are no tax advantages, but there are no limits to your contributions either.

- 529 – These accounts allow you to either prepay tuition for your child’s college or invest for their college expenses.

- Solo 401k – This one is for self-employed individuals who have no employees. You can make contributions as the employer and as the employee. There are two varieties: Traditional and Roth.

- Health Savings Accounts – These are generally checking accounts that you can withdraw funds from to pay for medical expenses. However, some accounts allow you to link an HSA Brokerage account so you can invest your HSA funds. These can be employer sponsored, or self-directed. There are no penalties or even taxes for withdrawing from this account to pay for medical expenses. There is a 20% penalty if you are withdrawing for non-medical expenses. After age 65, you can withdraw for any reason and not pay a penalty, only taxes on the distribution.

It’s important to note that I have only covered the basics and there are a lot more rules and nuances regarding each account. If there is an account that you have available to you, I suggest you fully research everything relating to that account prior to making your decision.

Comparison

Both employer sponsored and self-directed investment accounts allow you to invest for your future. They both also have limits and specific requirements. Plus many of them give you the option of using the Traditional version or the Roth version.

The biggest difference between employer sponsored accounts and self directed accounts is that employer sponsored accounts tend to have limited investment options, since the company decides what they will allow you to invest in. This means that the options within the account could be expensive to you in the long run. Also, when going with a self-directed account you get to select an account that won’t charge you any fees to begin with and find the investment options that have low fees there as well.

Invest Early and Consistently

Regardless of whether your employer offers retirement investment accounts you have the option of investing for your own future. No matter which option, or options, you choose make sure you take the time to set yourself up for success. Even just a small weekly contribution can lead you to have a lot more money than you otherwise would have if you’d only saved instead.

Leave a Reply