I use FIRE and FI interchangeably because I can’t imagine wanting to continue working after I’m financially independent, so the day I become FI will be the day I RE.

I have a short list of things I must have in order so that I can quit.

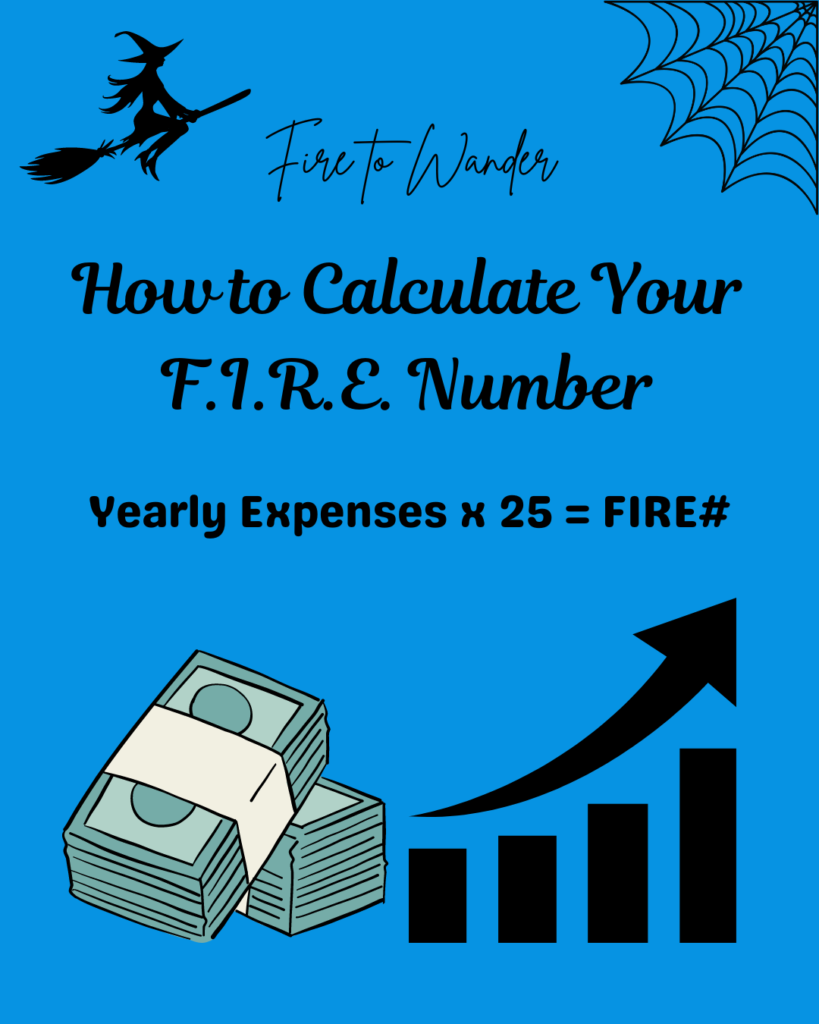

Here’s the simple way to figure out what amount you need to have invested in order to be financially independent.

If you don’t know how much you spend each year, figure out your monthly expenses first.

If you have no idea how much you spend each month, here’s how you can get a rough estimate:

- Start with your fixed monthly costs like rent and any expenses that are the same every month.

- For variable expenses like utilities: look at your bills for the past year and average them out, if you have them. If you don’t, then try to remember what your highest bill was and use that. This will overestimate, but it’s better to slightly overestimate than to underestimate.

- Start tracking what you spend on everything else for the next week or two, but don’t change anything. Just observe where your money goes. Make sure you keep a written record though. Multiply that number to get how much you’d spend in a month.

- You can even add on an extra 10%-15% for anything you’re forgetting.

Now that you have a rough idea of how much you spend per month, multiply that by 12.

This is your rough FI estimate.

This can be your starting FI goal. It doesn’t mean it’s exact yet, because you should be tracking your expenses over the course of a year or even more just to be sure that it’s accurate. You can’t go wrong by having this as your initial goal though. It’s a great place to start!

I’ve learned that even though your goal may be a certain number in the beginning, the number can change as you realize you don’t need or want to spend as much.

Mind-blowing Fact

I recently heard on a podcast that for every $100 you cut out of your monthly spending that is $30,000 less dollars that you need to FIRE.

(100 x 12) x 25 = 30,000

That’s math! I’m sure the more we continue down this path, the less value we’ll see in buying certain things that don’t bring us joy because we will prefer to be financially free sooner.

Lower Costs

We don’t even have to focus on not buying things, we can zero in on lowering the cost on the things we already buy.

For example: I spent some time getting a quote for bundling my home insurance and my car insurance and that saved me almost $500!

You can also get a lower phone or cable bill by shopping around or even asking your current company for a better rate. I actually did that with my internet provider.

Improve Your Income

Of course it also goes without saying that we can always earn more money to get to our goal faster.

Personally, I had several side hustles going so that I could afford to invest as much from my regular paycheck as possible, but still have fun money coming in!

I’m excited about continuing my journey to Financial Independence!