There are a lot of budgeting methods out there. Plenty of rules about what you’re supposed to spend on what. When I first started reading about these types of rules, I was very discouraged because at the time I wasn’t making much money and there was a limit to how much I could lower my spending.

Lowering your spending is a lot more doable once you start making more than the minimum you need to survive. So if that’s your situation right now, don’t stress too much about the “rules” just work on increasing your income so that you’re able to live comfortably and save/invest as much as you can. Make sure you have a plan for what you ultimately want your life to look like though, because oftentimes when people increase their income they just increase their spending in general rather than in an area that really matters to them. Be mindful about how you want your life to look and spend in that manner.

The 50-30-20 Rule

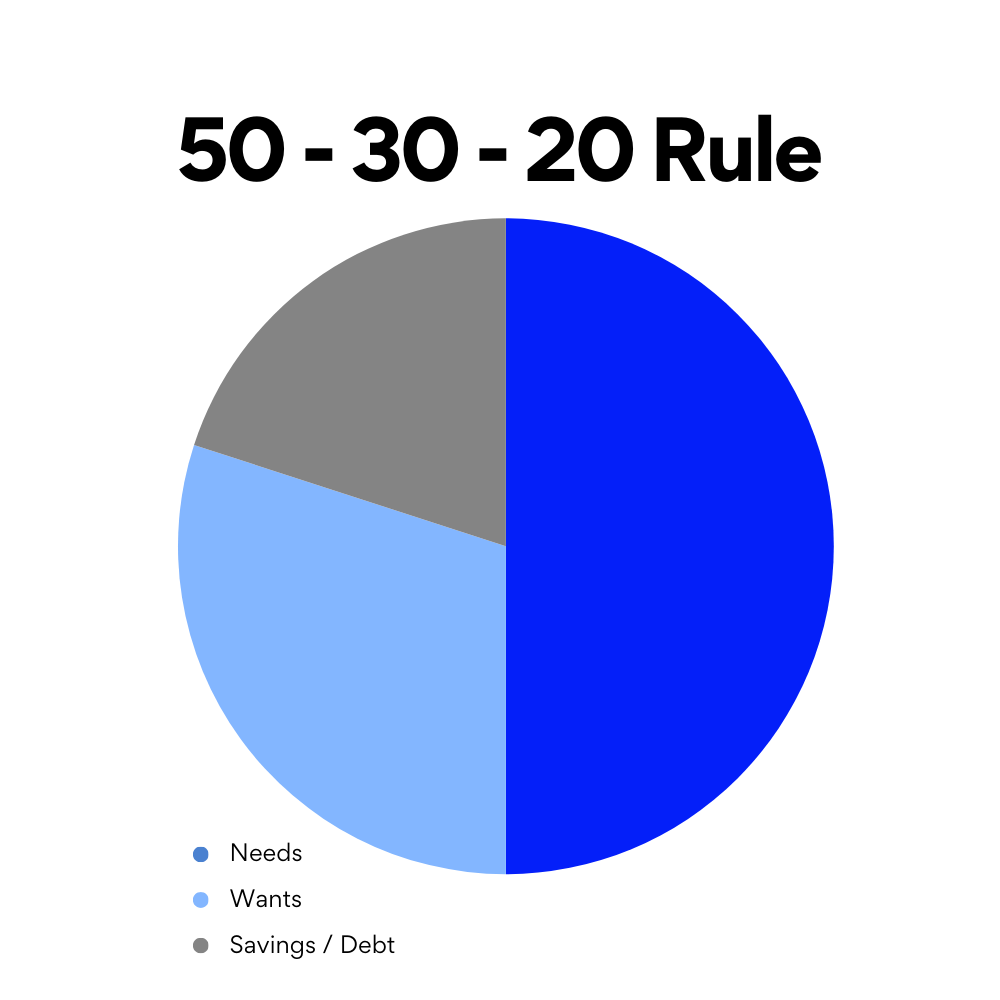

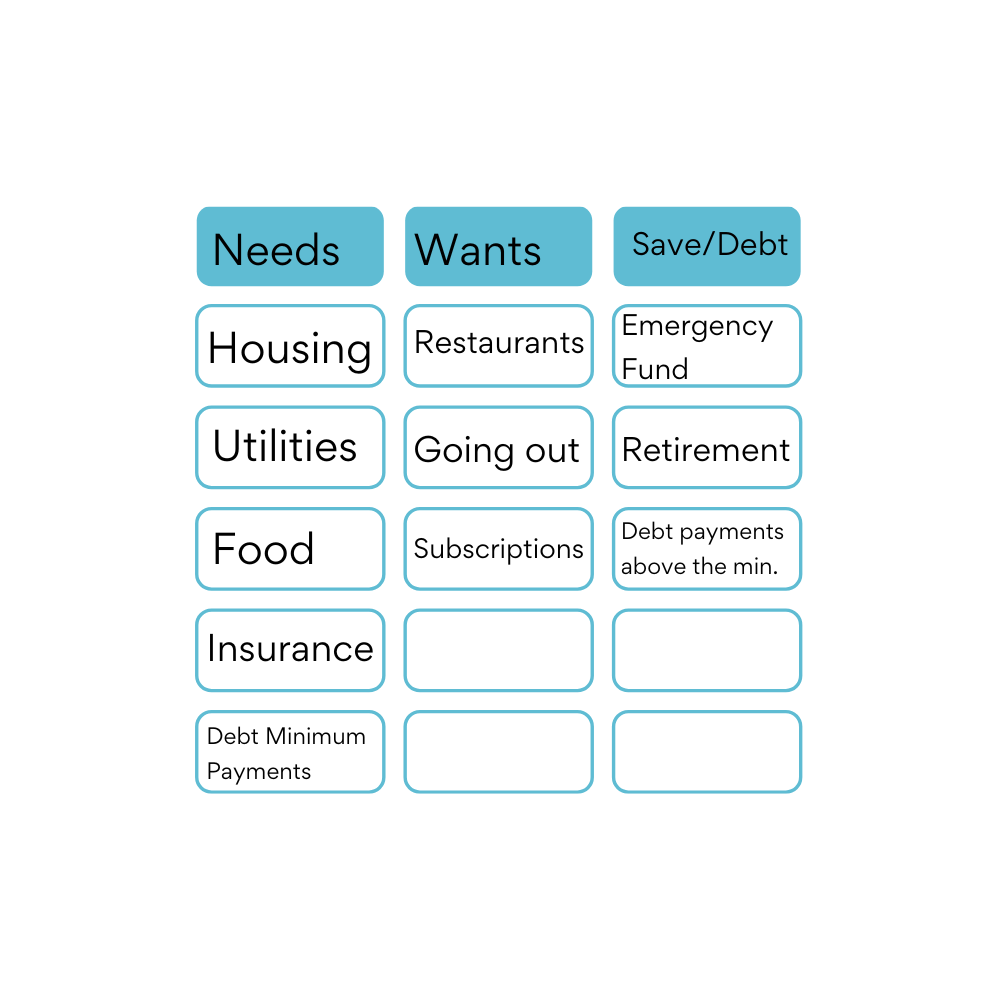

The budgeting rule that I break is called the 50-30-20 rule. Using this rule, you are supposed to spend 50% of your income on your needs, 30% on your wants, and 20% on savings and debt payments.

To figure out the amounts you’ll use for each category, get your latest paycheck stub to see what’s deducted. You’ll take your gross income (pre-tax and deductions) and subtract the taxes. The remaining number is what you’ll use to figure out the amount you should be spending on each category.

For example:

Let’s say my monthly salary after subtracting taxes is $4,000.

I will now multiply:

- 4,000 x .5 = 2,000

- 4,000 x .3 = 1,200

- 4,000 x .2 = 800

Here’s a table to illustrate how the rule is meant to be used. I’ve added some categories, but not nearly everything that should be added.

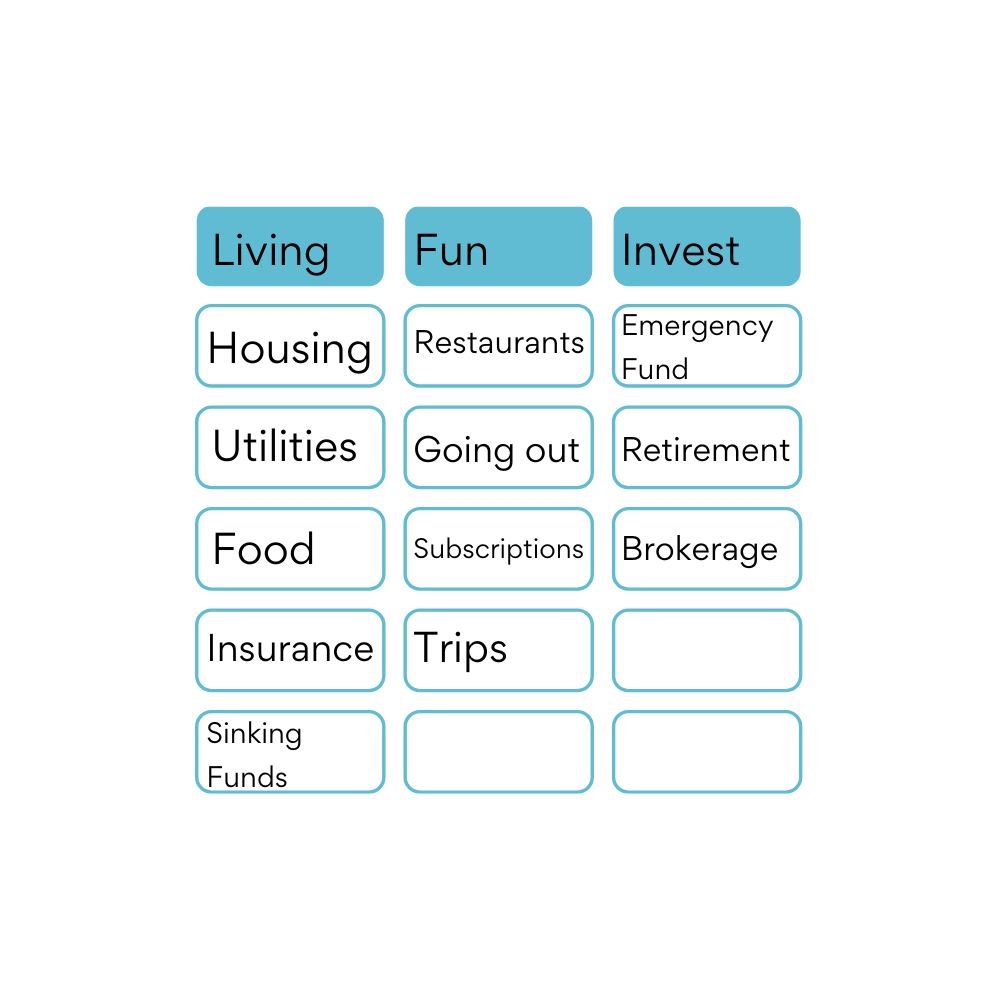

My Journey

Back when I was first starting out and living on my own, I was using a lot more than 50% on my needs. I kept increasing my salary and each time I was able to get closer to the 50%. Eventually my goal became to shrink that category as much as possible and increase the Investing category. My Wants category has stayed pretty consistent since I first started budgeting, so the percentage has shrunk as my salary has increased. Remember that your budget should be based on what your goals are and my goal is to stop working, so that’s what I prioritize.

I’ve never been a rule follower, so regardless of the “rule”, I do what I want.

I break the rule by putting almost all of my expenses in the Needs category, which I label “Living,” I have a small Wants category, which I label “Fun” and I always try to get as much of my income as possible into the Investing/Savings category.

How I started:

The first thing I did was to start tracking my spending. At the time, I found out about an app called Mint and through it I was able to see all of my spending in all of my accounts in one place. I loved how easy it was to see everything I spent and everything I had in each account all in one convenient location. I stopped using that app about a year or perhaps two years ago because I finally learned that if a product is free, the product is actually you. I no longer want to share my financial data with anyone, so now I track my spending on a spreadsheet by manually downloading the data from each credit card about every quarter. I don’t like using cash, since I tend to lose it, so this system works well for me.

There are plenty of apps or software that help you track your financial data, however now that I’m more privacy conscious I haven’t been able to find one that I like.

The next step was to figure out if what I was spending was acceptable to me and my goals.

Side note: I didn’t learn how to cook when I was in college, like I should have. I finally started learning how to cook after I turned 30. Gasp! I was alone-alone and realizing that I need to learn how to cook in order to keep myself alive in a healthy way. So I started learning from YouTube videos and Instagram posts. I am now capable of not only making myself food, but making myself delicious and nutritious food that I don’t have to take forever on. It’s been a total game-changer for me. That was all to say that back then when I started tracking my spending I realized I was spending over $800 per month on feeding myself. This was mainly eating out, but it was also wasted groceries from when I optimistically thought I might cook.

Finally, I decided what parts of my spending I needed to amend. Needless to say: $800 per month for food was not acceptable to me and my goals, so I started packing my lunch 3-4 times a week. (Now I actually take my lunch every day, unless something knocks my routine out of wack. I really like my own food, so it’s not a sacrifice by any means.)

I also gave myself a monthly allowance that I could spend on whatever I wanted and broke it up into a weekly number. This allowed me to be able to buy a tea whenever I felt like it or get that whatever that I realized I needed. Or simply go out to eat with a friend. Honestly, it was mainly spent on going out with friends and still is now. Having a weekly number to track makes it so much easier for me. I have a tiny notebook where I write what I spend. I inevitably forget to write it down and then have to log into my credit card accounts to get the info. Find a method that works for you.

Action Steps:

- Track spending to see where the money goes.

- Envision the life you want to have and see if your current spending habits reflect that.

- Decide where you can make any change, if any is needed.

- Give yourself an amount you can spend on whatever you want so you can easily keep track of the amount you should stay under for the week.

Leave a Reply