Everyone has heard of 401k accounts. Many people have heard of 403b accounts, which are the 401k equivalent for those in public education or non-profit organizations.

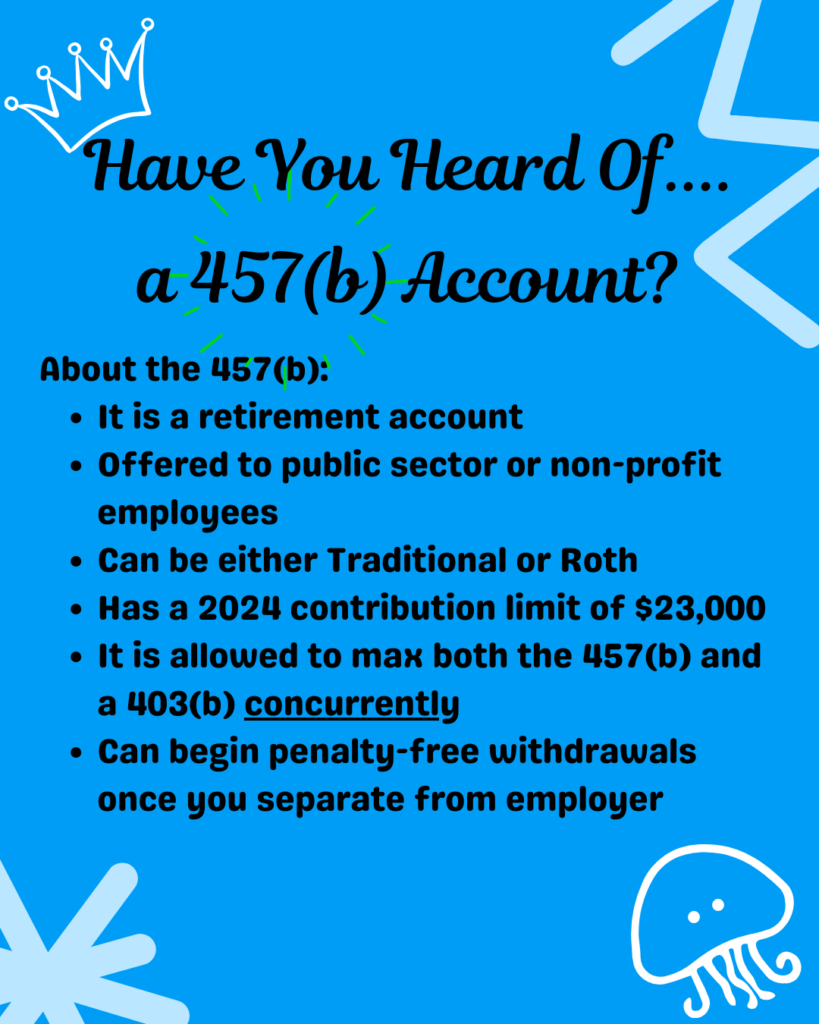

I want to teach you about the hardly known, 457b account.

Who is Eligible for Them?

These accounts are also retirement accounts that are available for state and local government employees, public education employees, and some non-profits as well.

Contributions

For 2024, the contribution limit is $23,000, which is equal to that of the 401k or the 403b.

A participant can contribute up to 100% of their salary to this account, as long as it doesn’t go over the annual contribution limit.

Catch-up contributions: Individuals age 50 or over at the end of the calendar year, can make catch-up contributions of up to $7,500 in 2024.

FIRE Benefit: If you are eligible for a 457b as well as either a 403b or a 401k, it is important to note that you can contribute to BOTH a 457b AND a 401k/403b and contribute the maximum yearly amount to both accounts. I wrote 401k/403b because for those types of accounts even if you are eligible for both you can only contribute up to the yearly maximum to the accounts combined. This means means that you can contribute $12k to one and $13k to the other, or any other combination, but not $23k to each.

Tax Treatment

The 457b is available in a Traditional version, which means that your contributions will lower your taxable income for the year since you will not be taxed on the amounts you contribute. This also means that during retirement when you withdraw your funds, you will pay taxes on the distributions at that point.

It is also available in a Roth version, which means that you would pay taxes on the full amount you earned and contributed into the account. However, when you withdraw your funds you will not be taxed on those distributions.

Investments

Within the plan, much like a 401k or a 403b, you are limited to certain investments selected by the organization you work for and whoever their plan manager is.

Fees

The plan fees will vary greatly depending on who your organization has servicing the account as well as if there are any intermediaries.

Every ETF or Mutual Fund is going to have fees, you just need to look at what the Expense Ratio to see what percentage you will be charged in fees. As a guideline, less than 0.5 percent is acceptable. Although you do want as low of an expense ratio as possible. For illustration, VTSAX has an expense ratio of 0.04% and SWPPX has an expense ratio of 0.02%. I’m not necessarily recommending those, I just pulled up a couple I could remember and checked their expense ratios.

According to Ramit Sethi’s book, I Will Teach You to Be Rich, a 1% fee can reduce your returns by about 30%. So you want to ensure your fees are low.

Distributions

457b accounts have very different rules from most retirement accounts. With 457b accounts, you can begin withdrawing from your account after you leave your organization with no penalty! You do pay regular income taxes on the withdrawals though, if you chose the Traditional version.

FIRE Benefit: This means you have an investment account that you can begin to draw from as soon as you retire early! With no early withdrawal penalties!

Rollovers

If you leave your employer and you’re not ready to retire yet, you can roll over the account into most other types of retirement accounts. The IRS has a chart you can use to see the specifics.

One thing I do want to caution you about regarding rollovers is that if you roll over your 457b into a different type of account, you will lose the benefit of withdrawing the funds without penalty upon separation from the employer.

My Experience

When I was a public school teacher, I had the option to contribute to a 403b and a 457b. That district had chosen an AWFUL servicer who charged two different percentages in addition to whatever fees you had to pay for the mutual funds available to invest in. I did choose to invest a few thousand in that plan even though I already saw the fees were high because although I was maxing out my 403b, I still had more wages that I wanted to shelter. Plus, I planned on using those funds when I left so that I could take time off in between jobs since I knew I would be leaving education and wasn’t sure how long it would take to find an acceptable job.

I ended up finding a job and starting two weeks after the school year ended so I didn’t even use the fund.

I think I made the right decision investing within the account, even with the high fees. I didn’t have that plan for too long, yet I still managed to see my money grow and I was able to roll it over into my new 457b account.

Thankfully, my new account does not have a separate servicer who charges extra and the company who houses it does not charge me anything other than the fund expense ratios. I don’t know if this will change once I am no longer employed at that organization. I will look into that when I am ready to depart.

I am currently funding it as much as I can so that I can use those funds for a break between this job and my next job. If there are no extra fees after I leave, I might just let it sit around and wait for me to reach 45 so I can start using it to fund my early retirement before I can start withdrawing from my IRAs at 59 1/2.

My plans can and do change, so the only thing I can plan on for sure is that I will fund it as much as possible so that if or when I change my mind I know I have the flexibility to do as I wish.

Leave a Reply