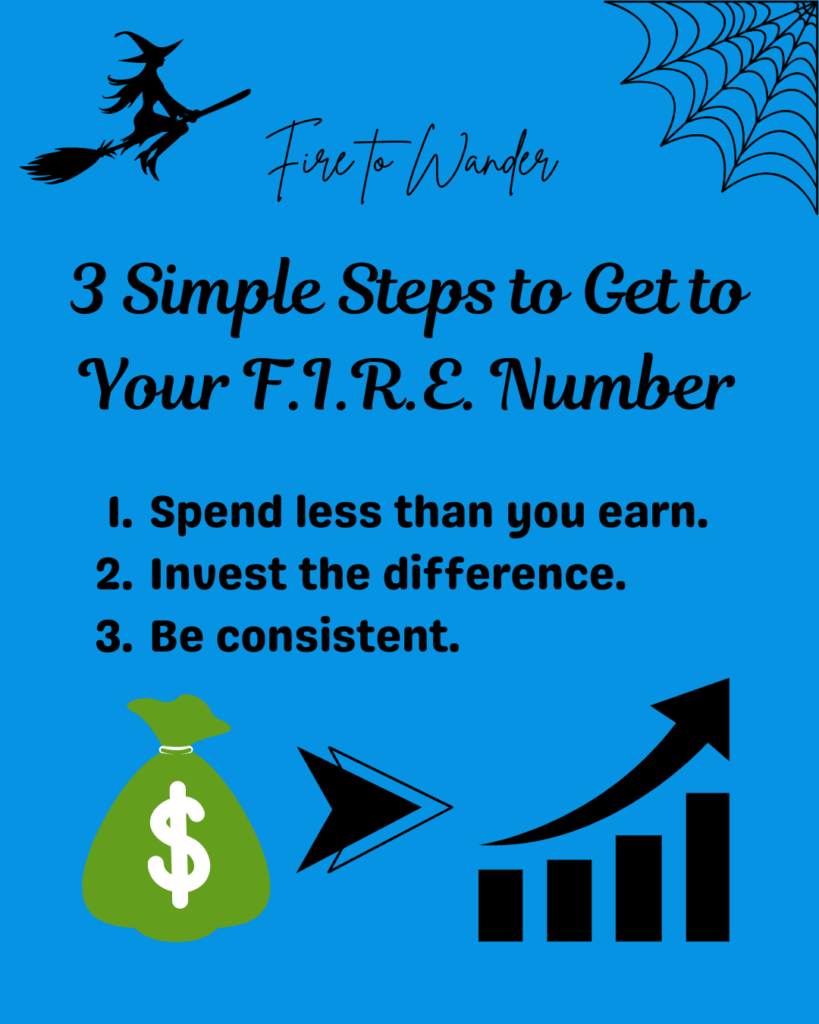

It might sound too good to be true, but honestly this is exactly what you need to do, as simple as it sounds.

- Spend less than you earn.

- Reaching FI is only possible if you do not spend everything you make. Even worse, you can never reach FI if you always spend MORE than what you make. This step boils down to learning to save part of what you earn.

- Invest the difference.

- If you earn $400 for the week and you are able to invest $10. You are already starting off by building a great habit. The important part in the beginning is not to save everything or even as much as you can. The important part is to start the habit of saving. That is the difficult part. Once the habit is there, it will be easy for you to start increasing your savings every time you earn more.

- Be consistent.

- Investments are a tried and true method for achieving wealth. However, this does not happen overnight. You must be patient and continuously invest money on a consistent basis so that you can see progress.

There are plenty of ways you can optimize savings, taxes, investments, account types, yada yada yada.

None of that means anything until you have these three things down.

If you are just starting your journey, you will be way ahead of the pack by simply practicing these things.

Once you start to get to the point where you feel comfortable with easily saving the same amount each pay period or increasingly saving more each pay period, then you will be ready to think about more advanced things relating to personal finance.

Leave a Reply